InvoiceNow GST Operation

Activation of InvoiceNow GST Submission

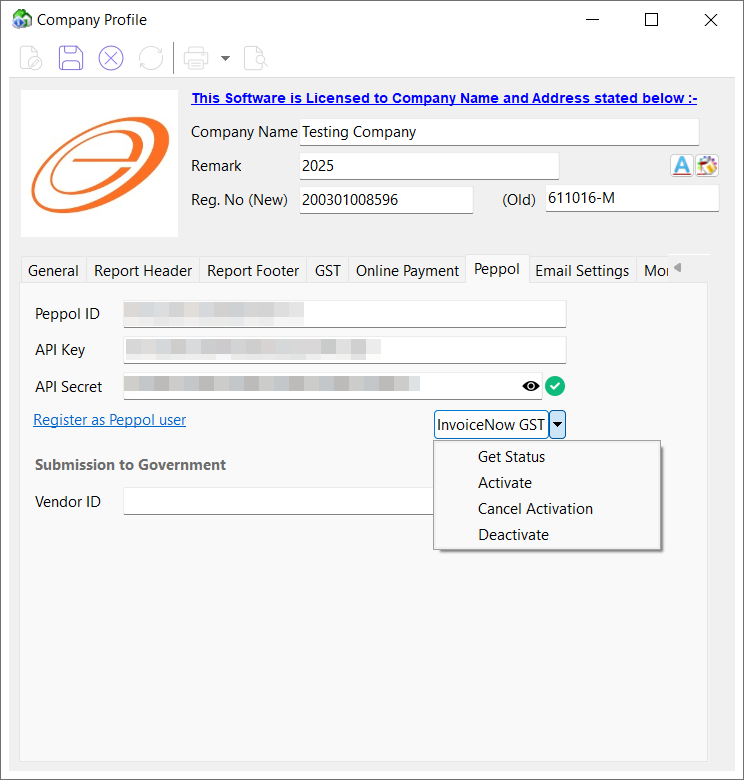

To activate InvoiceNow GST submission for GST-registered Businesses, navigate to File > Company Profile > Peppol and perform the actions below:

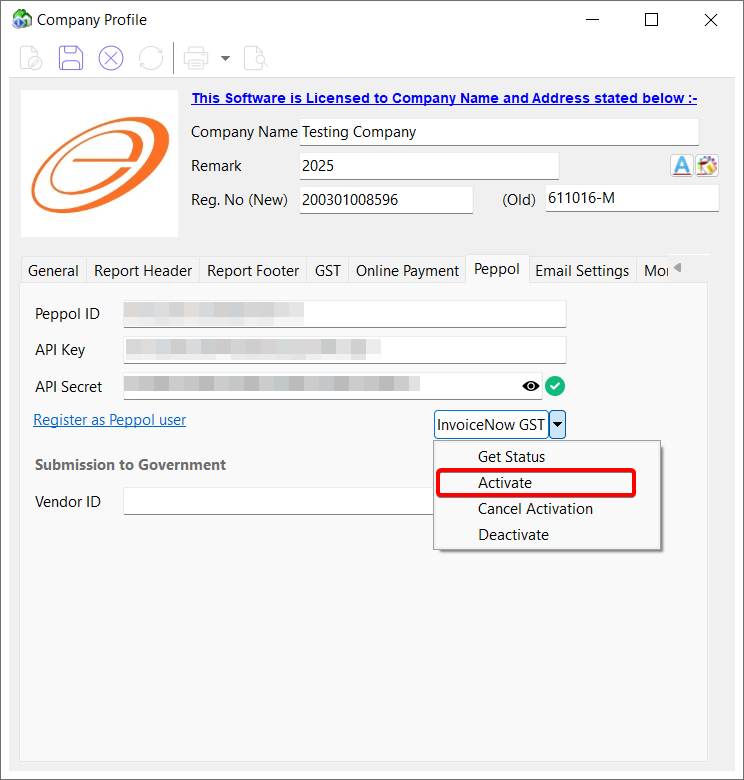

Activate

To initiate InvoiceNow GST activation for specified participants and organizations. Activation requires signing with Corppass.

- Click on InvoiceNow GST > Activate

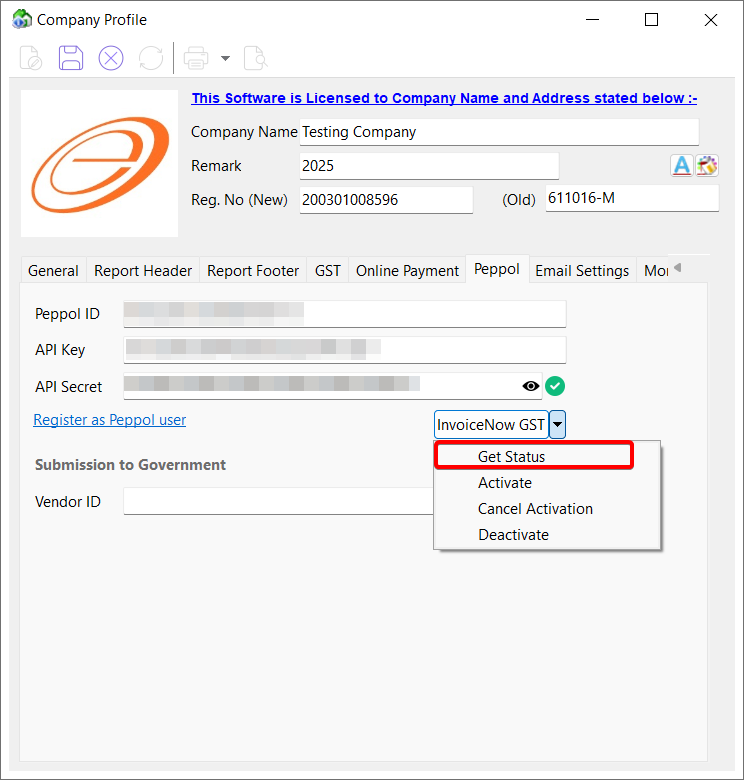

Get Status

To check the InvoiceNow GST activation status for a specific participant and organization.

- Click on InvoiceNow GST > Get status

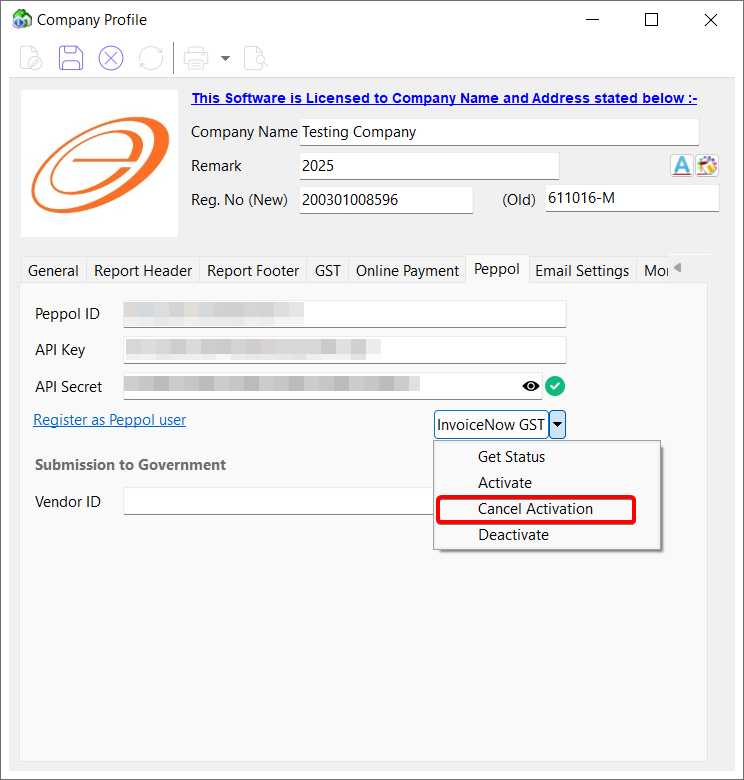

Cancel Activation

To cancel an initiated InvoiceNow GST activation, a KYC pending InvoiceNow GST activation or a InvoiceNow GST deactivation.

- Click on InvoiceNow GST > Cancel Activation

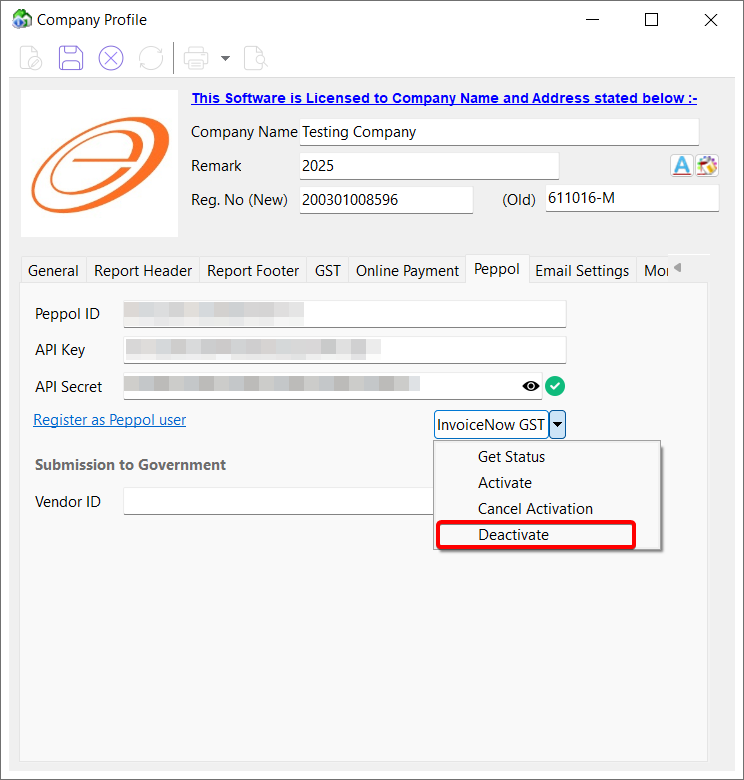

Deactivate

To deactivate an existing InvoiceNow GST activation. Deactivation requires signing with Corppass.

- Click on InvoiceNow GST > Deactivate

Extraction and Packaging of Invoice Data

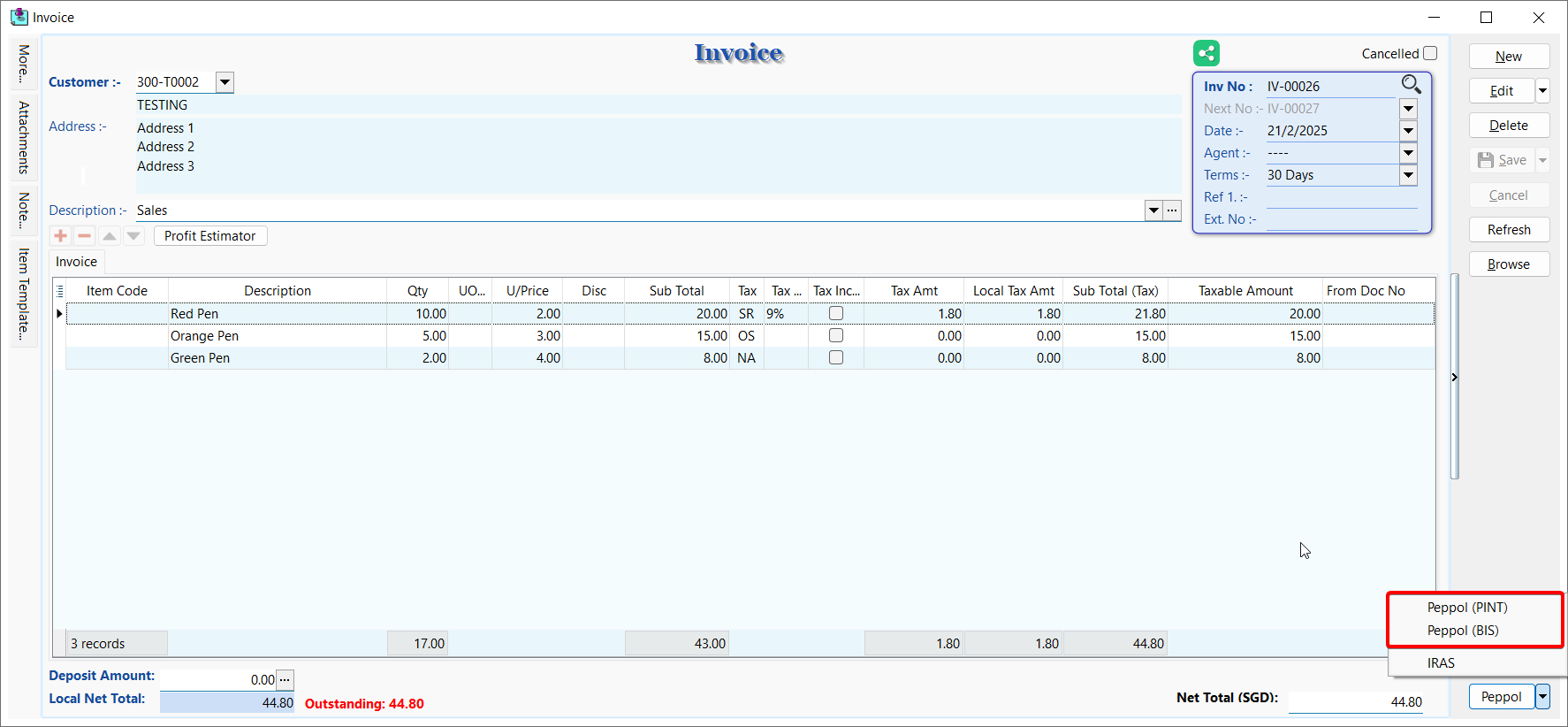

Type 1A (Peppol)

This type will submits documents to the Peppol network and automatically forwards them to IRAS. You may use this type when the customer is on Peppol.

- Supported format: PINT (Default), BIS

- Supported document types: Sales Invoice, Credit Notes

Click on Peppol > Peppol (PINT) or Peppol (BIS)

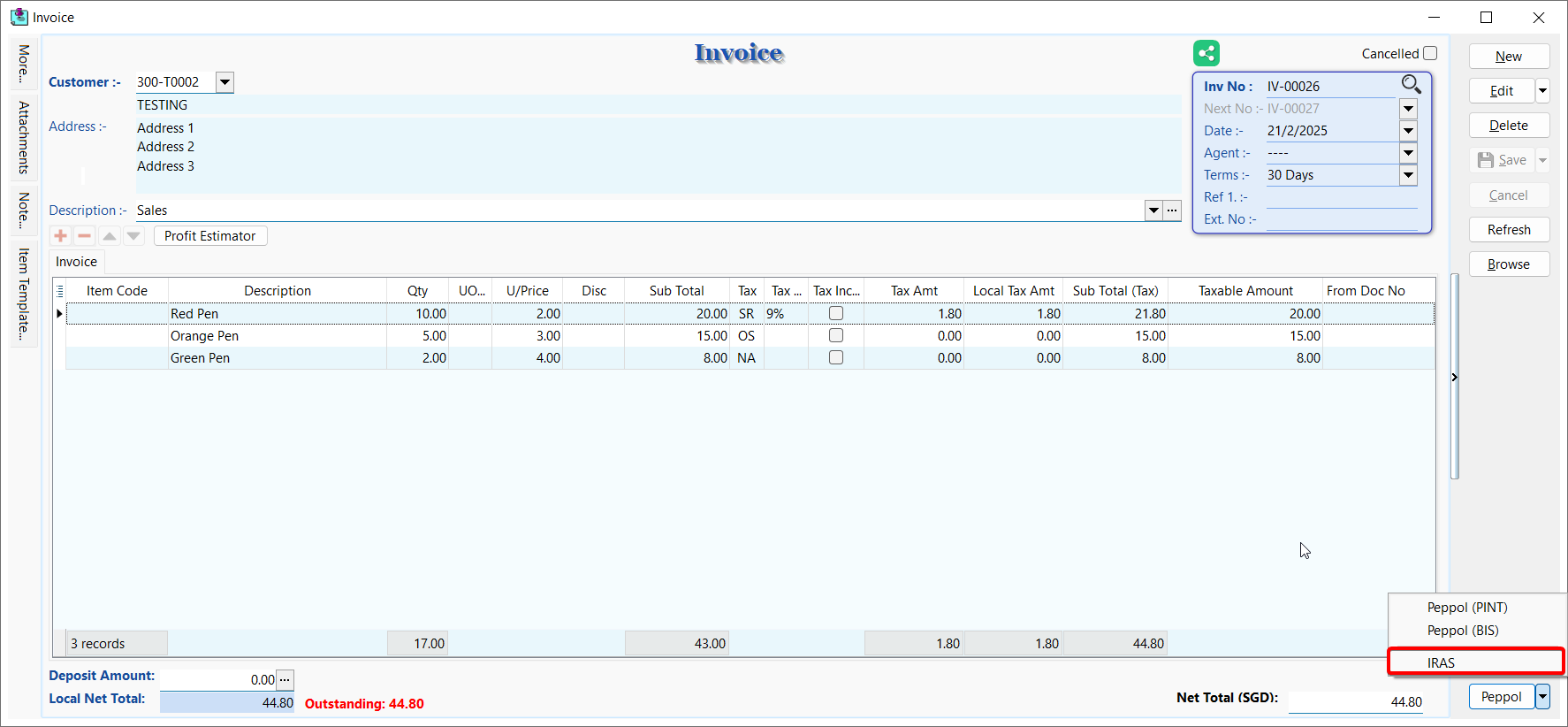

Type 2A (Non Peppol)

This type will submits documents directly to IRAS.

NOTE

Supported format: PINT

Supported document types: Sales Invoice, Credit Notes

- Click on Peppol > IRAS

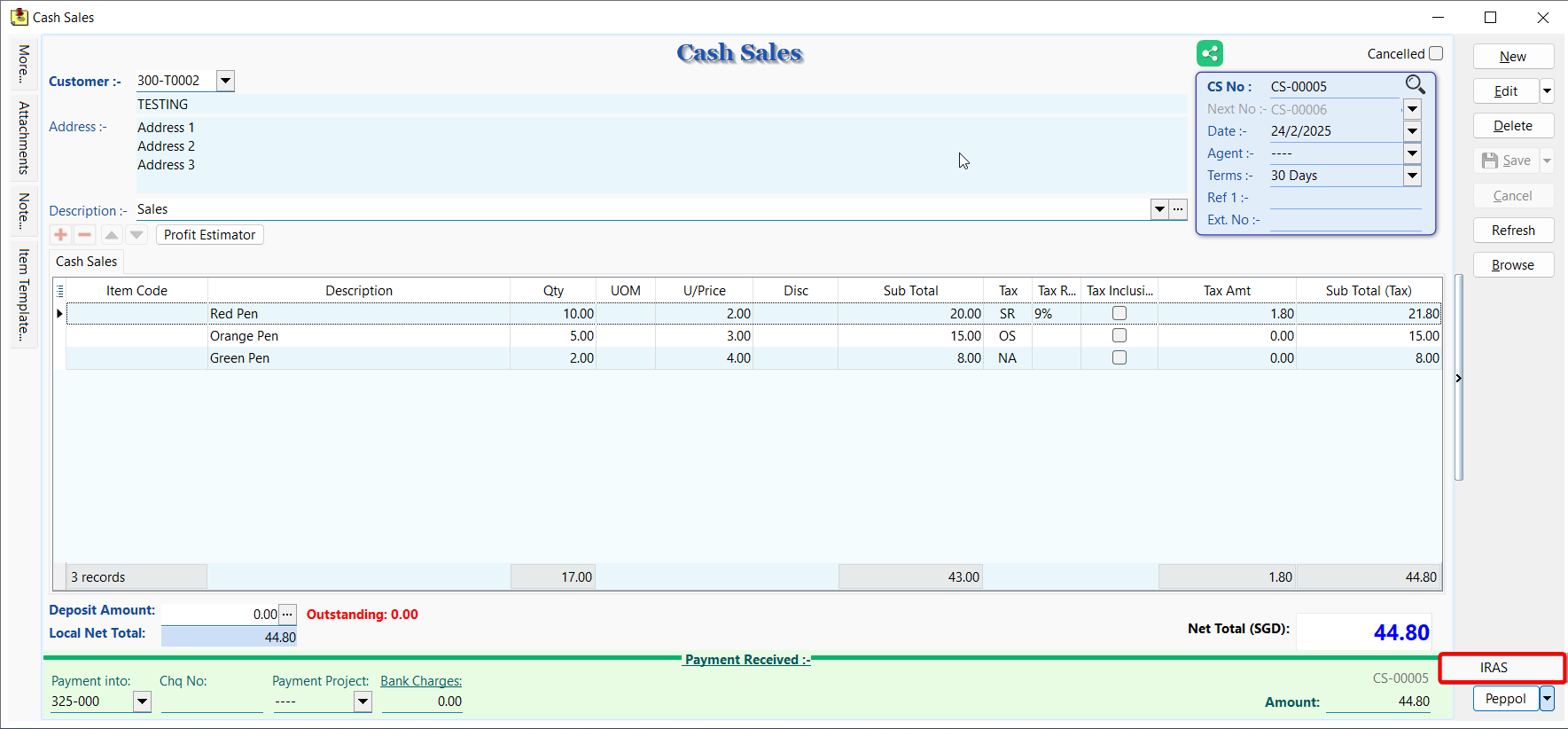

Type 2B (POS or STI)

This type will groups items by tax code and submits documents to IRAS. You may use this type for cash register sales or sales made via point-of-sale systems (POS) or simplified tax invoices issued (STI).

NOTE

Supported format: PINT

Supported document types: Cash Sales

- Click on Peppol > IRAS

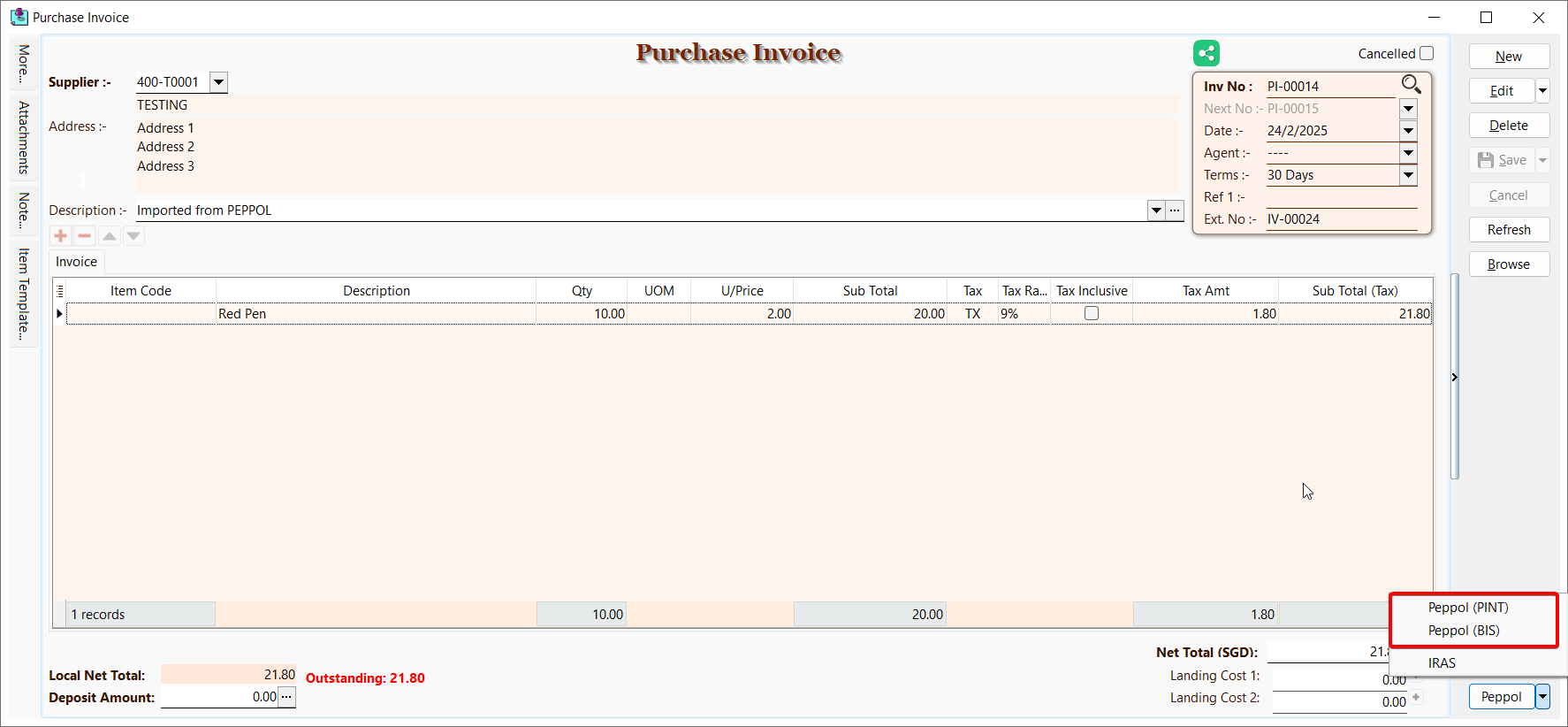

Type 1B (Peppol Received)

This type will submits received documents via the Peppol network and forwards them to IRAS. You may use this type for documents imported using Peppol.

NOTE

Supported format: PINT (Default), BIS

Supported document types: Purchase Invoice, Purchase Returned

Click on Peppol > Peppol (PINT) or Peppol (BIS)

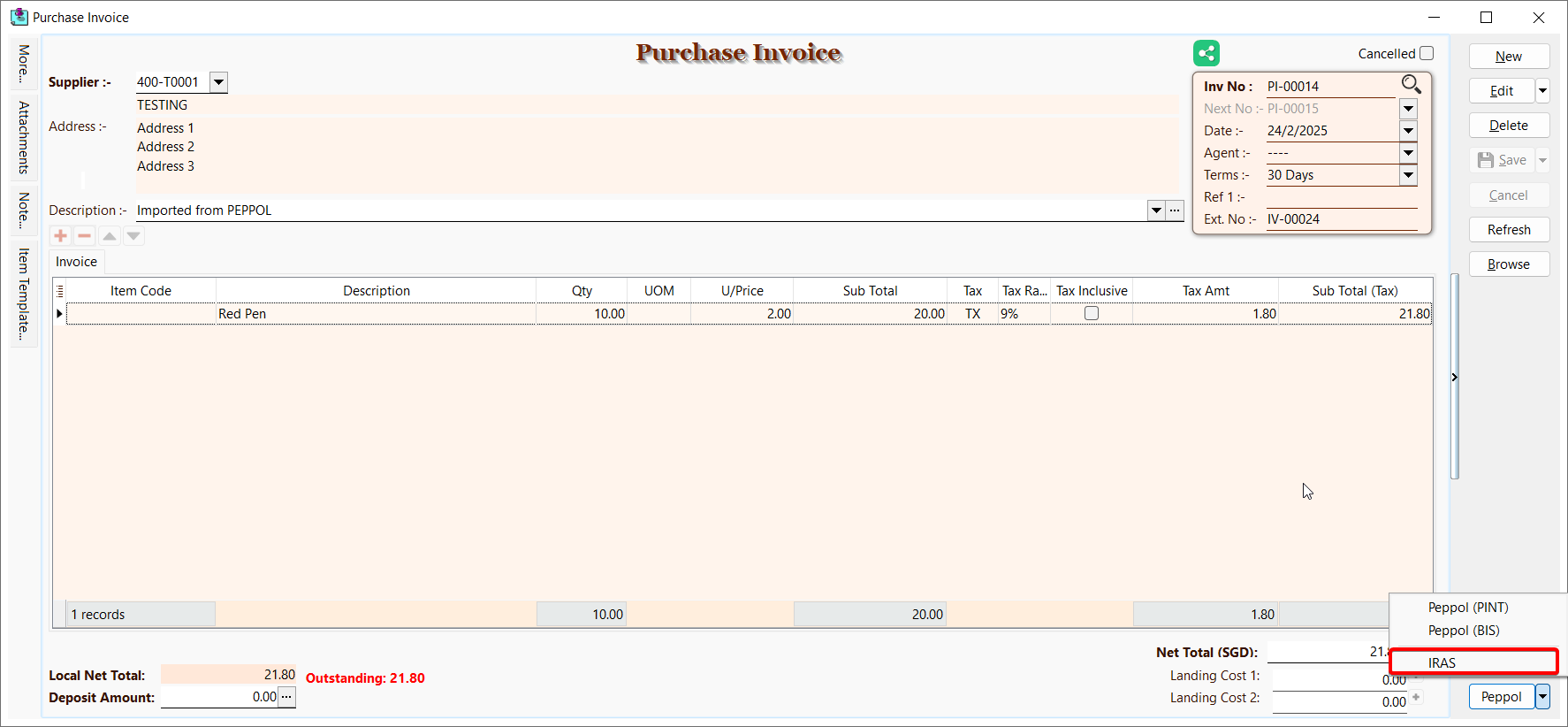

Type 3A (Non Peppol Received)

This type will submits received documents directly to IRAS.

NOTE

Supported format: PINT

Supported document types: Purchase Invoice, Purchase Returned

Click on Peppol > IRAS

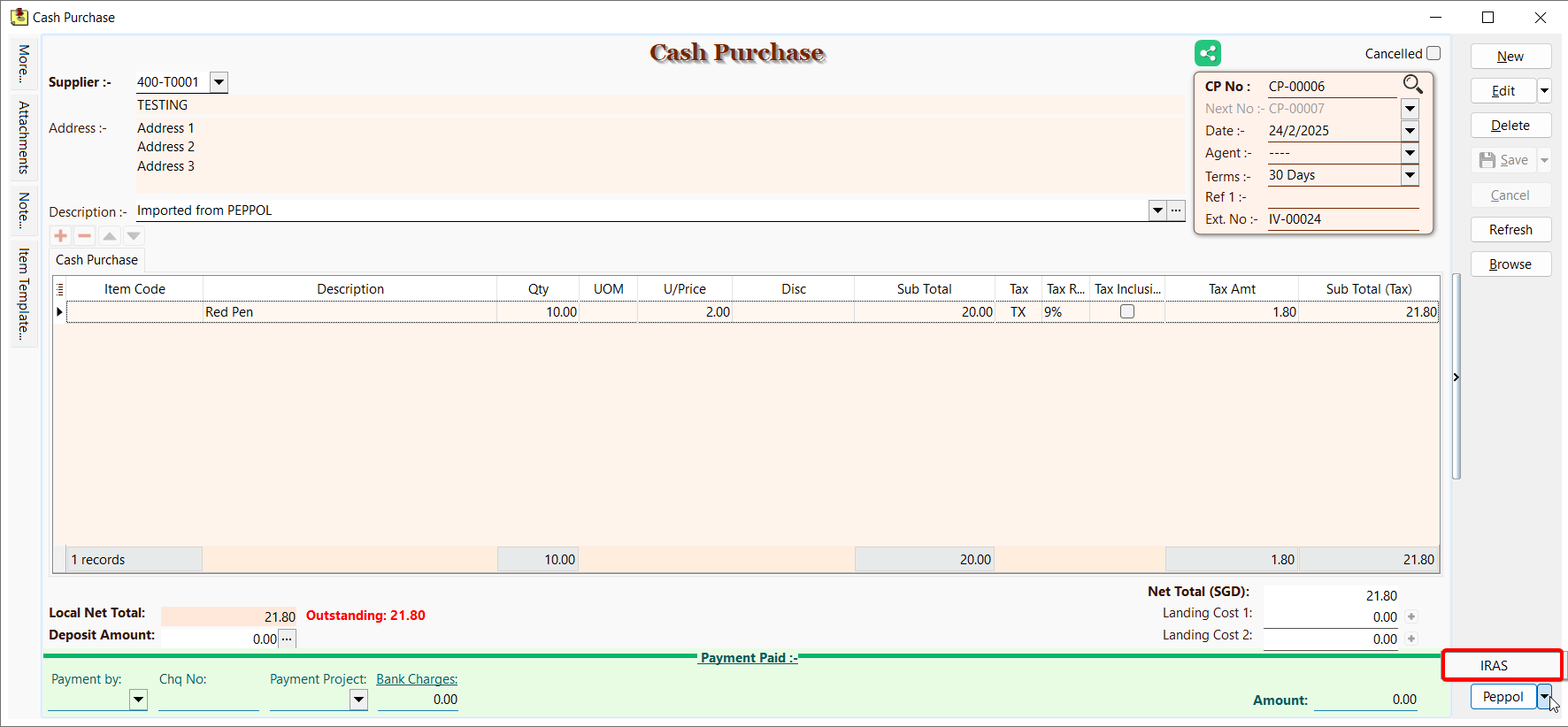

Type 3B (PCP)

This type will groups items by tax code and submits documents to IRAS. You may use this type for petty cash purchases (PCP).

NOTE

Supported format: PINT

Supported document types: Cash Purchase

- Click on Peppol > IRAS

Reporting & Reconciliation

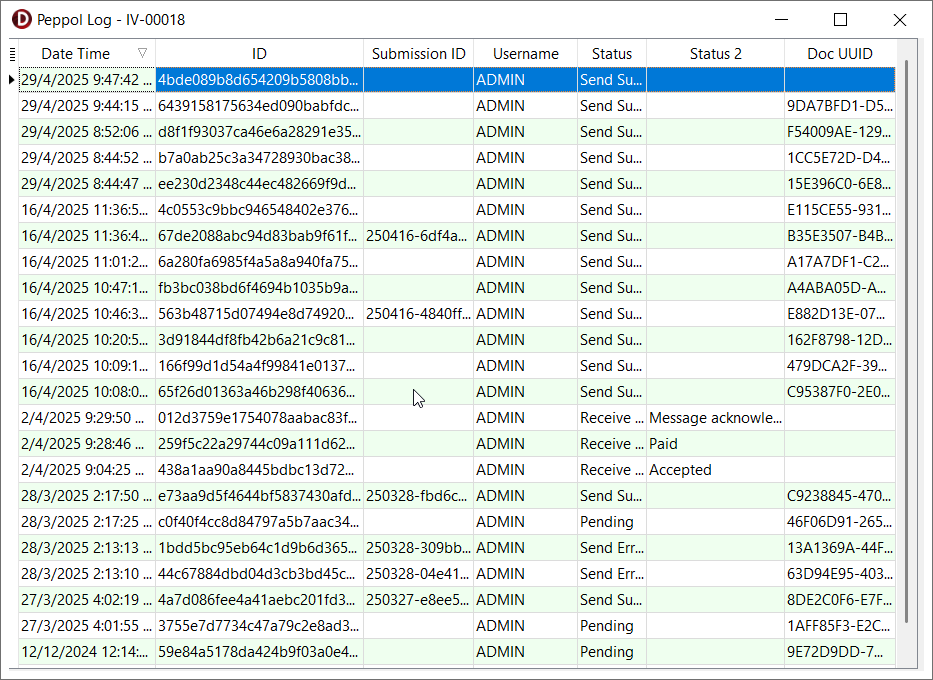

Log

To check the Peppol log of a document.

NOTE

The Remark column stores the IRAS Acknowledgement ID

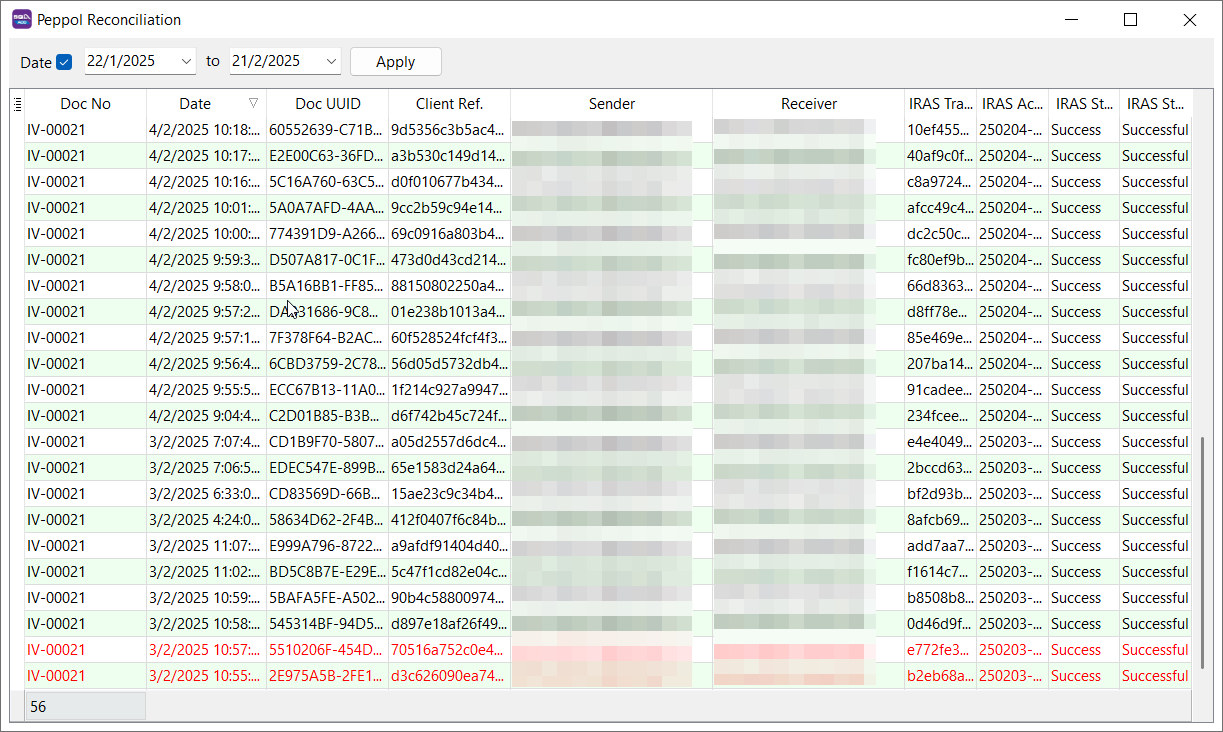

Reconciliation

To compare document submissions in SQL Account and the Peppol network.

NOTE

The record highlighted in red color indicate missing document submissions in SQL Account